Someone on your leadership team has said these words.

It’s a lot cheaper to retain a customer than it is to acquire a new one.

You’ve heard it. You might have even said it. But are you really going to decide to spend 100% of your marketing budget on retention vs. acquisition? Or vice versa?

This binary thinking isn’t always helpful, at least not theoretically. But, when you are thinking of your roadmap, your forecast, your cash runway, and your next fundraising round (because you will need outside capital again, and you should be thinking about that now), short-term growth hacking is not your savior.

Note: This post is not about acquisition strategy. Retention is how you maximize the value of your company. Over the long run. Retention is so much more important than the all consuming thought “I need to buy some time until the venture markets thaw and I can get the valuation I deserve.”

Someone on your leadership team (doesn’t matter the title) needs to create the shared understanding about the value of retention for YOUR business.

There are 3 main ways you should consider investing in improving customer retention:

- Longer lifetime duration of ARR streams means greater cash flow to the business. I dig into this a bit more below.

- Better retention numbers signal high switching costs. These businesses have pricing power, which means higher growth rates for new and existing customers, as well as greater profitability. (This will be the subject of a future post.)

- Higher retention numbers (should) lead to higher multiples for your valuation. (This will also be a subject of a future post.)

I’m betting you are focused on 2 primary KPIs for this year. First, I bet you have set goals for new ARR. (I’ll include expansion ARR here as well.) Second, you have likely forecasted ending ARR. “Wait,” you say. “Doesn’t this imply that I care about churn? Because when we lose ARR that is reflected in our ending ARR.”

I reply “you care, but not enough.” And what I mean is that you should be thinking more fundamentally about your retention strategy and tactics.

Time for some math

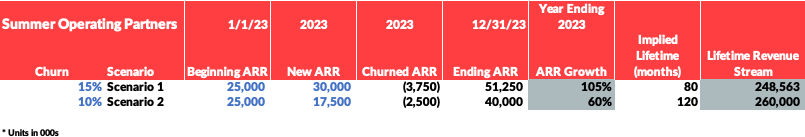

So first, some simple math comparing 2 different scenarios. Imagine you are running a SaaS company with $25mm in ARR. In Scenario 1, you close new deals representing gross new ARR of $30mm, but churn 20% of your ARR over the year. Overall, your numbers look good. Your ending ARR is $50mm, representing 1-year ARR growth of 100%.

In Scenario 2, you grow new ARR by $17.5mm, and churn 10%. At the end of the year, your ARR is $40mm, representing 1-year ARR growth of 60%.

Scenario 1 is far better, right? Not so fast. If we assume that your churn numbers will be the same in the future, we can get a cleaner look.

In the table above, we see the cumulative cash flow streams including this year in Scenario 2 are actually greater than Scenario 1. (Apologies for not discounting these @jeffdiermeier). And we haven’t incorporated short-term cash flow differences (in marketing spend and additional sales reps).

Every quarter you are setting and resetting your goals. We should all be thinking about all of the levers in our businesses that we operate. Manage your retention as diligently as you manage your pipeline.